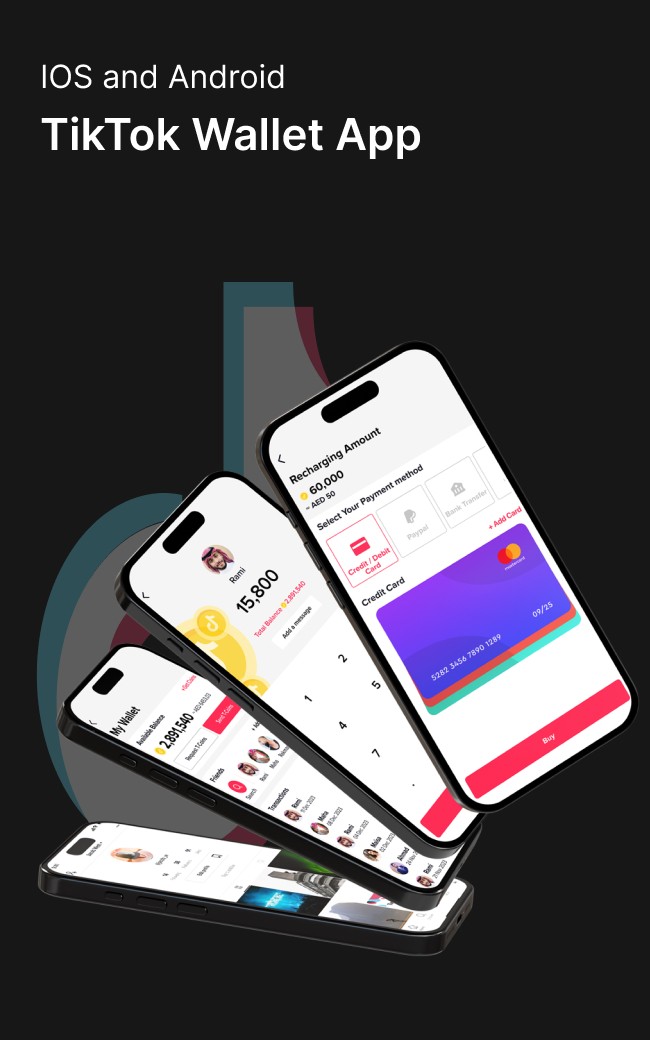

T-Wallet~Online Banking App

About

T-Wallet is a cutting-edge mobile application transforming the banking experience in Cyprus. Designed to address the inconvenience of traditional banking and the shortcomings of current digital solutions, T-Wallet offers a seamless, user-friendly platform for efficient financial management.

Challenge

Cypriot banks often rely on physical transaction processing, which is inconvenient in today's digital age. Existing banking apps are frequently complex, unintuitive, and unengaging, making it difficult for users to manage their finances effectively.

Solution

T-Wallet simplifies and enhances the banking experience with the following key features:

Immediate Transactions

Cashback Rewards

Plane Tickets and Currency Exchange

Savings, Credits

Donations and much more

Role

UX/UI Designer

Time Constraint

2 Months

Team

Faiz

Usama

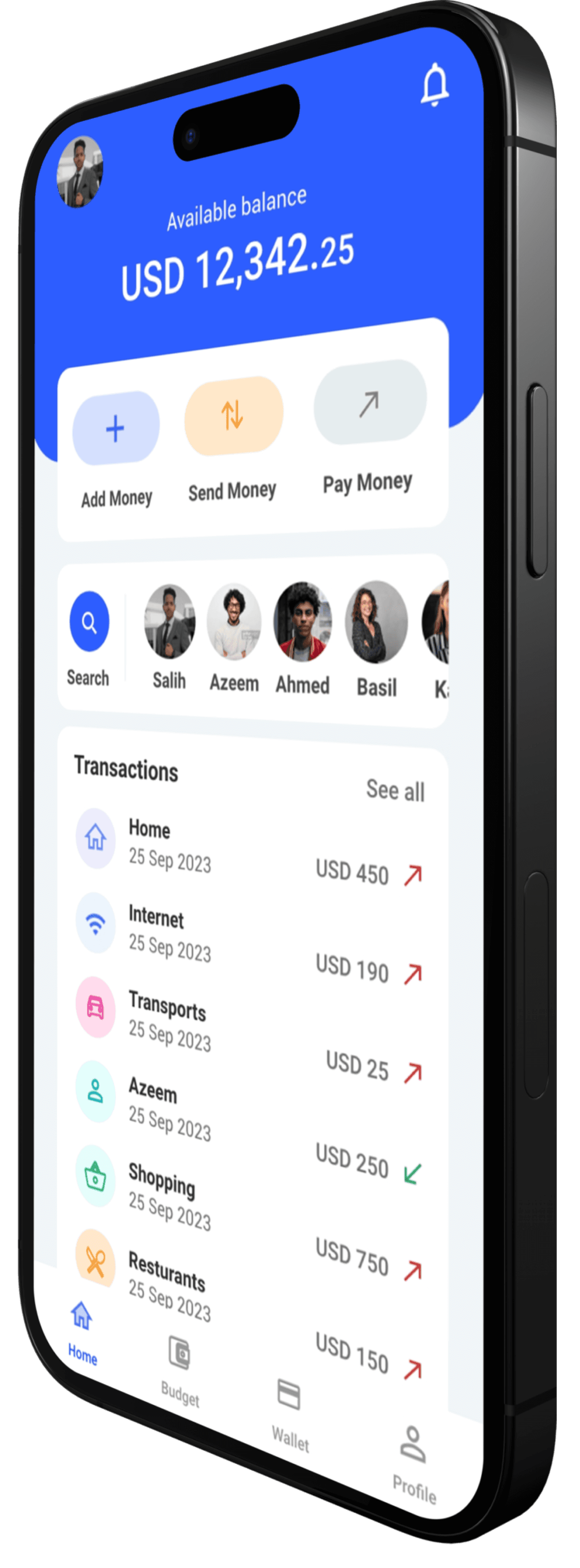

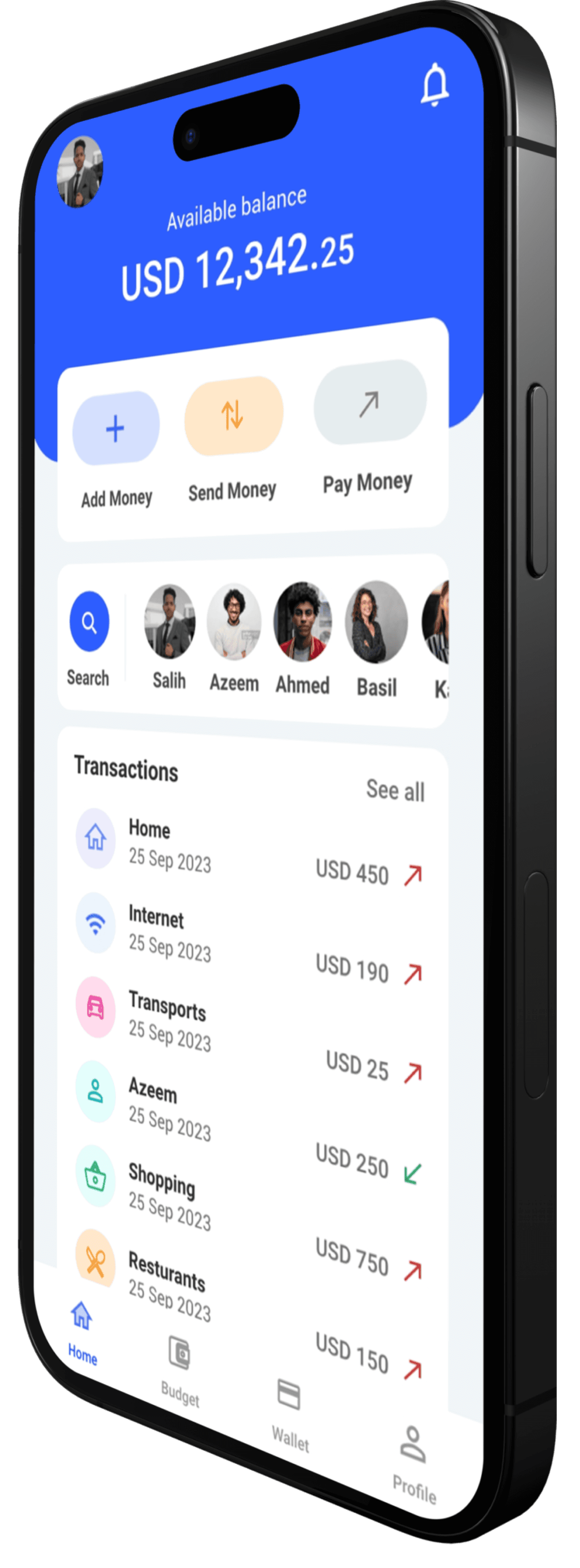

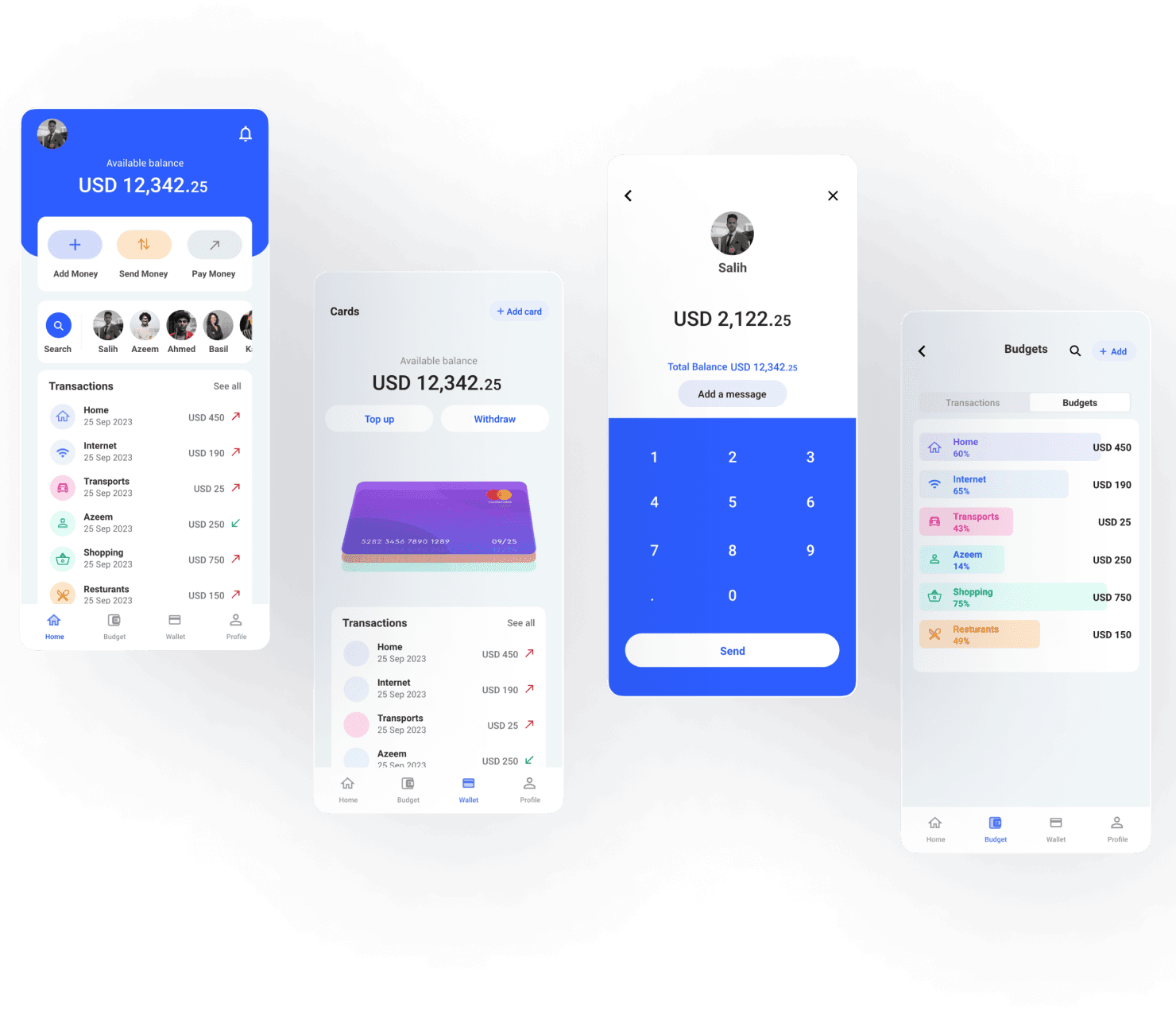

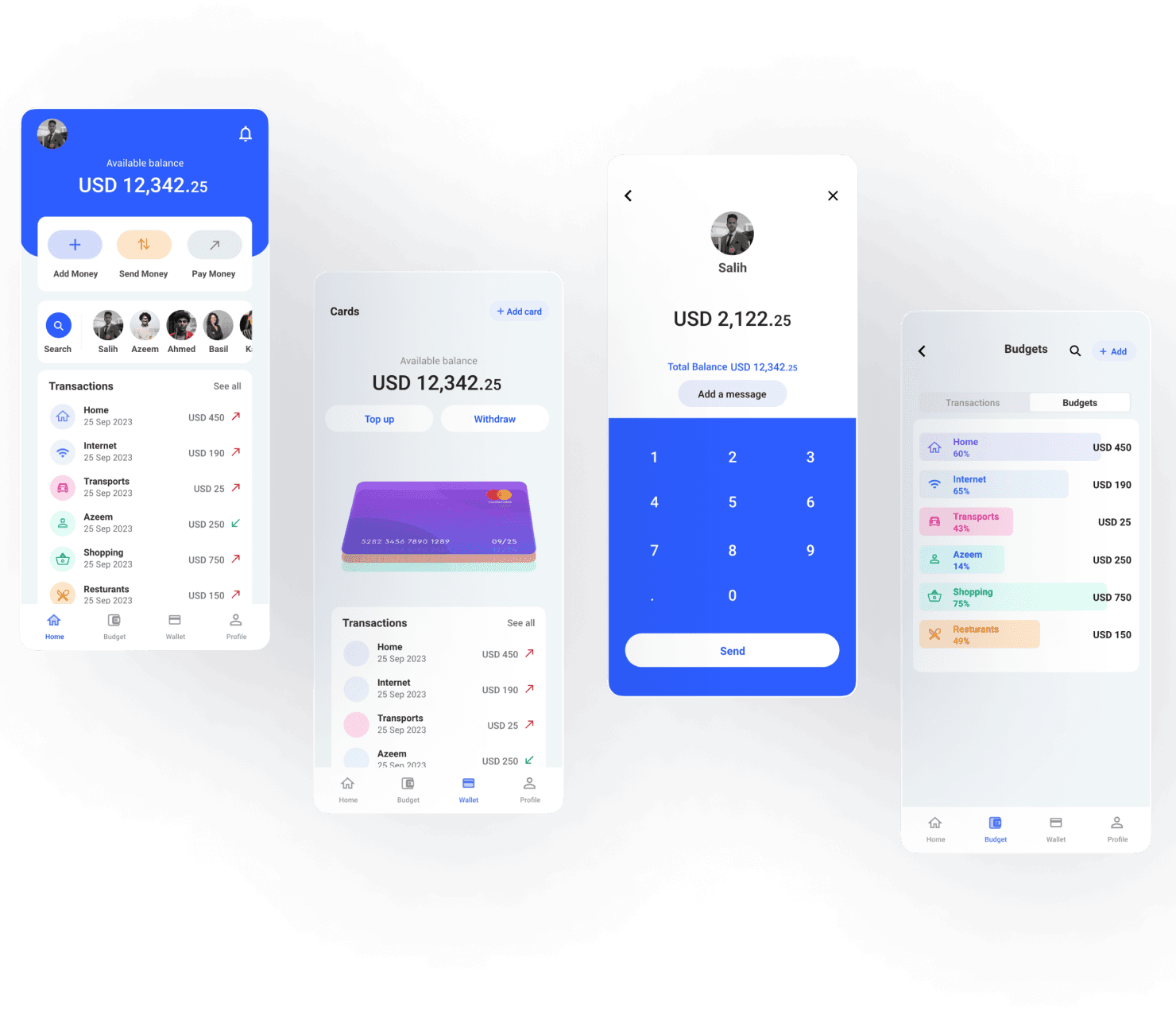

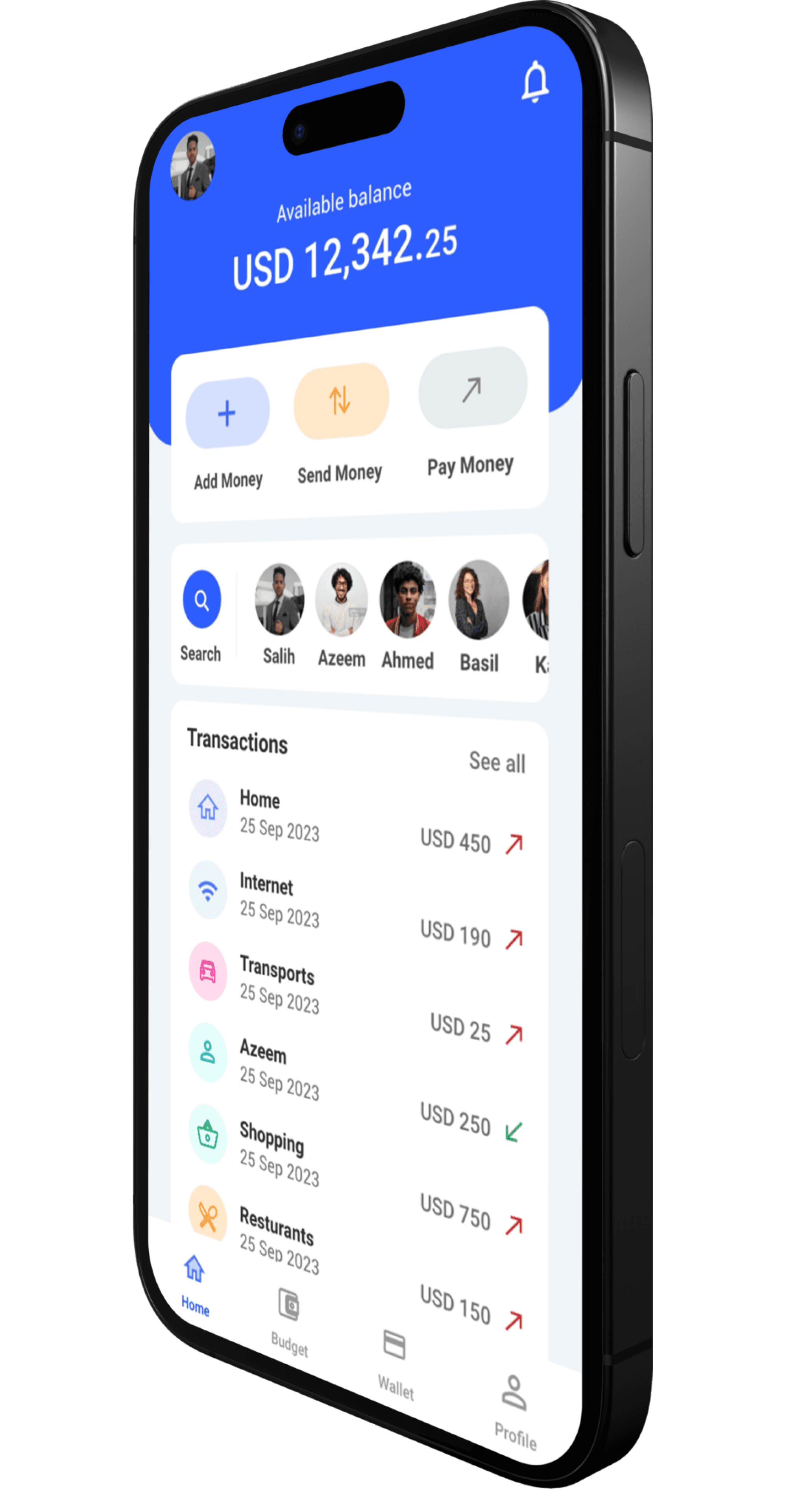

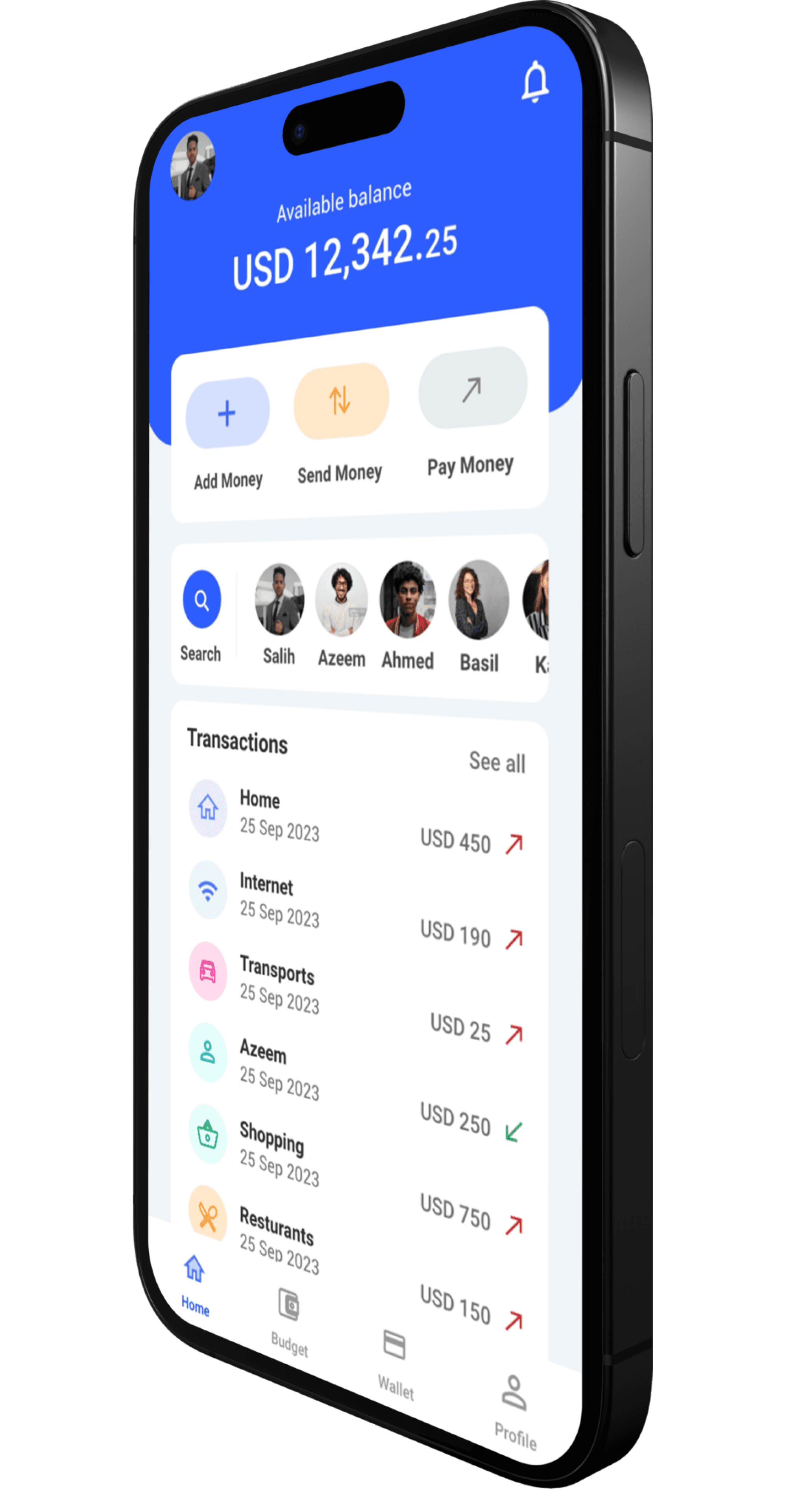

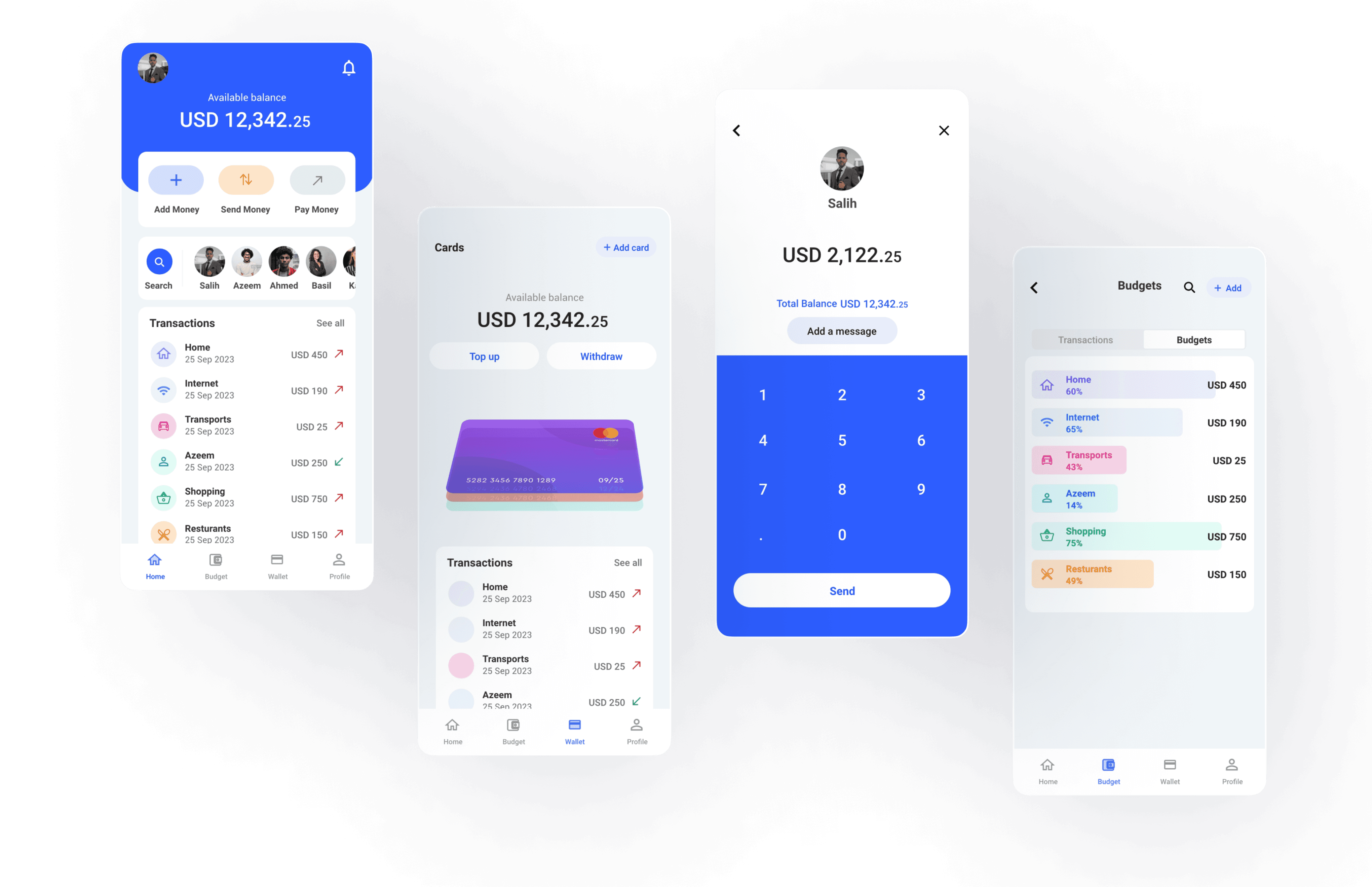

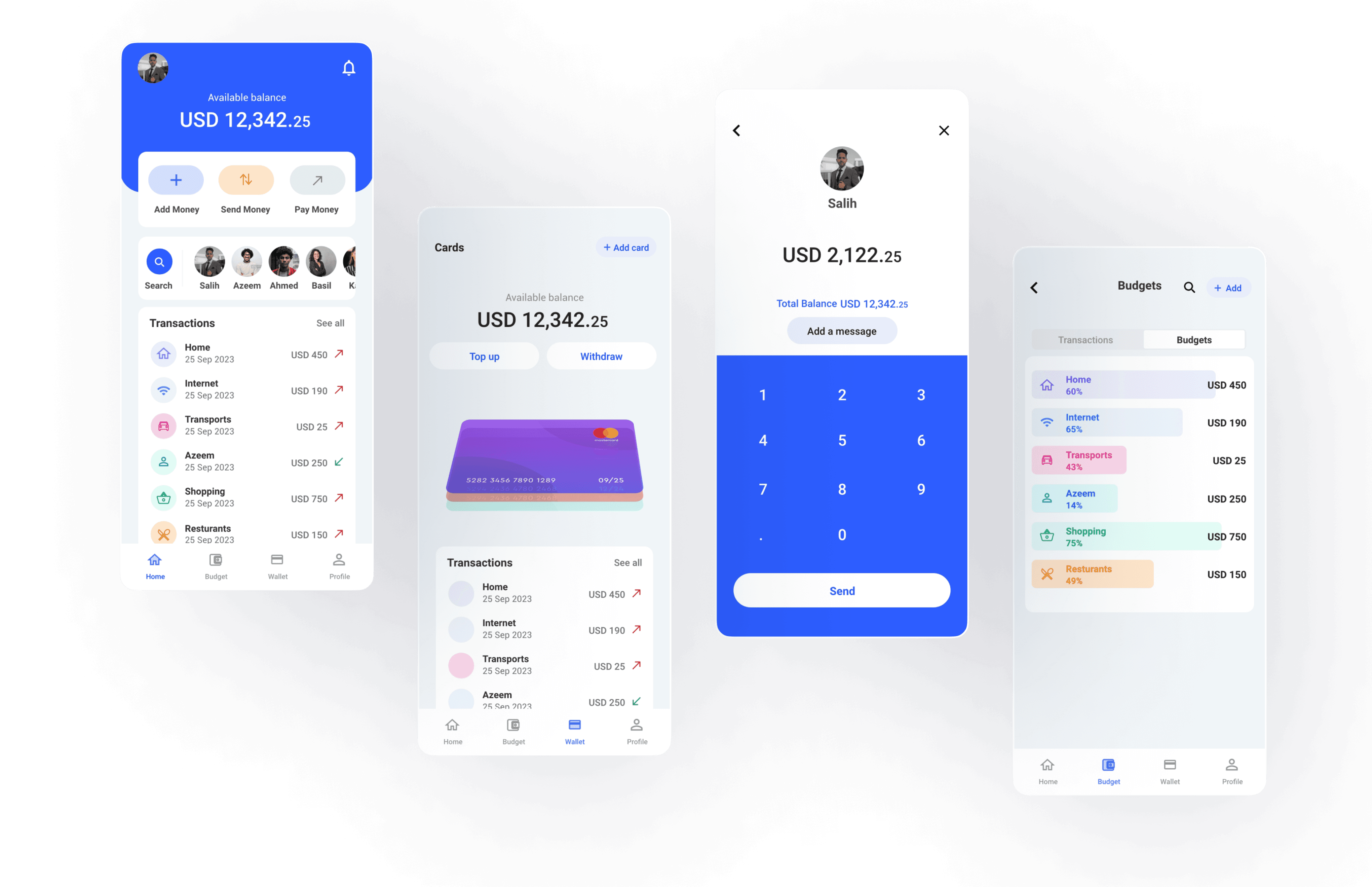

Main Screen

The main screen of the T-Wallet app is designed to provide users with a quick and comprehensive overview of their financial activities and access to essential features.

A list of the most recent transactions. Each transaction entry includes the amount, date, and a brief description.

At the bottom of the screen, a tab bar provides quick navigation to other key sections of the app.

App Features and Integration

T-Wallet allows seamless bill payments, money transfers, and integrates with services like eBay and Uber.

Users can add friends and family, facilitating easy and secure money transactions.

The app includes a budget tracker to monitor spending habits.

Exclusive vouchers for hotels and holiday destinations in Cyprus enhance user value.

Personas

Alex Brown

Age:

City:

Education:

Income:

Family:

22

Kyrenia, Cyprus

IT

800£ from Parents

Single

Time is money, so l need a banking app that saves me both

Behavior

Alex is proactive about managing his finances and regularly checks his bank account to stay informed about their financial situation. He prefers digital solutions and often multitask, using his smartphone.

Personality

Personality

organised

responsible

tech-savy

Technologies

smartphone

laptop

tablet

Bio

Alex is a busy college student juggling classes, part-time work, and extracurricular activities. He is studying computer science and are passionate about technology. As a student, Alex is always on the go and relies heavily on his smartphone for managing his life.

Disappointment

Alex gets frustrated with banking apps that have complicated interfaces or lack essential features for budgeting and expense tracking. They also feel let down by apps that prioritize flashy design over functionality, as they value practicality and efficiency.

Basic needs

Needs a banking app that provides real-time updates on his account balance and transactions, allowing him to monitor his income and expenses.

Requires features for setting budgets, categorising expenses, and receiving alerts when he exceeds budget limits.

The app should offer seamless functionality for everyday banking tasks like transferring money. paying bills, and depositing checks.

Expects the app to have robust security measures to protect their sensitive financial information from unauthorised access or fraud.

Wishes

Alex wishes for a banking app that offers personalised recommendations and insights based on his spending habits,

Helping him make informed financial decisions.

He would like the app to integrate with other financial tools and services he uses, such as budgeting apps for a unified financial management experience.

Alex hopes the app includes educational resources and tools to improve his financial literacy and help him achieve his long-term financial goals.

Alex Brown

Age:

City:

Education:

Income:

Family:

36

Magusa, Cyprus

Engineer

10,000£

Married

Behavior

Values his family time

enjoys comfort and speed

respects modern services

Personality

calm

balanced

creative

Technologies

PC

smartphone

laptop

Bio

John Smith, a 36-year-old businessman, is dedicated to both his career and his family. Married with two children, he juggles the responsibilities of running his own business while prioritizing quality time with his loved ones. Despite earning between $7,000 and $10,000 annually, John finds fulfillment in both his professional success and his role as a husband and father.

Usually suffer from the mess with arranging finances in everyday life. At work he has an accountant.

Disappointment

Always forgets about financial constraints and spend more in specific field than he should

The process of transaction processing and payment takes a long time, which delays receiving and sending money

Can't do payments, when physical bank is closed

Basic needs

Spend less time on solving "money" issues

Have the ability to pay travel tickets through the app. while traveling abroad and paying bills

Simplify the process of saving and separating money

Wishes

separate saved money for different fields

tickets and bills payment

simplifications of internet-banking usage

Nowadays,

"moneywork" should take less time to systematize businesses and spend saved time for more important things

T-Wallet~Online Banking App

T-Wallet~Online Banking App

About

T-Wallet is a cutting-edge mobile application transforming the banking experience in Cyprus. Designed to address the inconvenience of traditional banking and the shortcomings of current digital solutions, T-Wallet offers a seamless, user-friendly platform for efficient financial management.

Challenge

Cypriot banks often rely on physical transaction processing, which is inconvenient in today's digital age. Existing banking apps are frequently complex, unintuitive, and unengaging, making it difficult for users to manage their finances effectively.

Solution

T-Wallet simplifies and enhances the banking experience with the following key features:

Immediate Transactions

Cashback Rewards

Plane Tickets and Currency Exchange

Savings, Credits

Donations and much more

Role

UX/UI Designer

Time Constraint

2 Months

Team

Faiz

Usama

Main Screen

The main screen of the T-Wallet app is designed to provide users with a quick and comprehensive overview of their financial activities and access to essential features.

A list of the most recent transactions. Each transaction entry includes the amount, date, and a brief description.

At the bottom of the screen, a tab bar provides quick navigation to other key sections of the app.

App Features and Integration

App Features and Integration

T-Wallet allows seamless bill payments, money transfers, and integrates with services like eBay and Uber.

Users can add friends and family, facilitating easy and secure money transactions.

The app includes a budget tracker to monitor spending habits.

Exclusive vouchers for hotels and holiday destinations in Cyprus enhance user value.

Personas

Alex Brown

Age:

City:

Education:

Income:

Family:

22

Kyrenia, Cyprus

IT

800£ from Parents

Single

Time is money, so l need a banking app that saves me both

Behavior

Alex is proactive about managing his finances and regularly checks his bank account to stay informed about their financial situation. He prefers digital solutions and often multitask, using his smartphone.

Personality

Personality

organised

responsible

tech-savy

Technologies

smartphone

laptop

tablet

Bio

Alex is a busy college student juggling classes, part-time work, and extracurricular activities. He is studying computer science and are passionate about technology. As a student, Alex is always on the go and relies heavily on his smartphone for managing his life.

Disappointment

Alex gets frustrated with banking apps that have complicated interfaces or lack essential features for budgeting and expense tracking. They also feel let down by apps that prioritize flashy design over functionality, as they value practicality and efficiency.

Basic needs

Needs a banking app that provides real-time updates on his account balance and transactions, allowing him to monitor his income and expenses.

Requires features for setting budgets, categorising expenses, and receiving alerts when he exceeds budget limits.

The app should offer seamless functionality for everyday banking tasks like transferring money. paying bills, and depositing checks.

Expects the app to have robust security measures to protect their sensitive financial information from unauthorised access or fraud.

Wishes

Alex wishes for a banking app that offers personalised recommendations and insights based on his spending habits,

Helping him make informed financial decisions.

He would like the app to integrate with other financial tools and services he uses, such as budgeting apps for a unified financial management experience.

Alex hopes the app includes educational resources and tools to improve his financial literacy and help him achieve his long-term financial goals.

Alex Brown

Age:

City:

Education:

Income:

Family:

22

Kyrenia, Cyprus

IT

800£ from Parents

Single

Time is money, so l need a banking app that saves me both

Behavior

Alex is proactive about managing his finances and regularly checks his bank account to stay informed about their financial situation. He prefers digital solutions and often multitask, using his smartphone.

Personality

Personality

organised

responsible

tech-savy

Technologies

smartphone

laptop

tablet

Bio

Alex is a busy college student juggling classes, part-time work, and extracurricular activities. He is studying computer science and are passionate about technology. As a student, Alex is always on the go and relies heavily on his smartphone for managing his life.

Disappointment

Alex gets frustrated with banking apps that have complicated interfaces or lack essential features for budgeting and expense tracking. They also feel let down by apps that prioritize flashy design over functionality, as they value practicality and efficiency.

Basic needs

Needs a banking app that provides real-time updates on his account balance and transactions, allowing him to monitor his income and expenses.

Requires features for setting budgets, categorising expenses, and receiving alerts when he exceeds budget limits.

The app should offer seamless functionality for everyday banking tasks like transferring money. paying bills, and depositing checks.

Expects the app to have robust security measures to protect their sensitive financial information from unauthorised access or fraud.

Wishes

Alex wishes for a banking app that offers personalised recommendations and insights based on his spending habits,

Helping him make informed financial decisions.

He would like the app to integrate with other financial tools and services he uses, such as budgeting apps for a unified financial management experience.

Alex hopes the app includes educational resources and tools to improve his financial literacy and help him achieve his long-term financial goals.

Alex Brown

Age:

City:

Education:

Income:

Family:

36

Magusa, Cyprus

Engineer

10,000£

Married

Behavior

Values his family time

enjoys comfort and speed

respects modern services

Personality

calm

balanced

creative

Technologies

PC

smartphone

laptop

Bio

John Smith, a 36-year-old businessman, is dedicated to both his career and his family. Married with two children, he juggles the responsibilities of running his own business while prioritizing quality time with his loved ones. Despite earning between $7,000 and $10,000 annually, John finds fulfillment in both his professional success and his role as a husband and father.

Usually suffer from the mess with arranging finances in everyday life. At work he has an accountant.

Disappointment

Always forgets about financial constraints and spend more in specific field than he should

The process of transaction processing and payment takes a long time, which delays receiving and sending money

Can't do payments, when physical bank is closed

Basic needs

Spend less time on solving "money" issues

Have the ability to pay travel tickets through the app. while traveling abroad and paying bills

Simplify the process of saving and separating money

Wishes

separate saved money for different fields

tickets and bills payment

simplifications of internet-banking usage

Nowadays,

"moneywork" should take less time to systematize businesses and spend saved time for more important things

Alex Brown

Age:

City:

Education:

Income:

Family:

36

Magusa, Cyprus

Engineer

10,000£

Married

Behavior

Values his family time

enjoys comfort and speed

respects modern services

Personality

calm

balanced

creative

Technologies

PC

smartphone

laptop

Bio

John Smith, a 36-year-old businessman, is dedicated to both his career and his family. Married with two children, he juggles the responsibilities of running his own business while prioritizing quality time with his loved ones. Despite earning between $7,000 and $10,000 annually, John finds fulfillment in both his professional success and his role as a husband and father.

Usually suffer from the mess with arranging finances in everyday life. At work he has an accountant.

Disappointment

Always forgets about financial constraints and spend more in specific field than he should

The process of transaction processing and payment takes a long time, which delays receiving and sending money

Can't do payments, when physical bank is closed

Basic needs

Spend less time on solving "money" issues

Have the ability to pay travel tickets through the app. while traveling abroad and paying bills

Simplify the process of saving and separating money

Wishes

separate saved money for different fields

tickets and bills payment

simplifications of internet-banking usage

Nowadays,

"moneywork" should take less time to systematize businesses and spend saved time for more important things